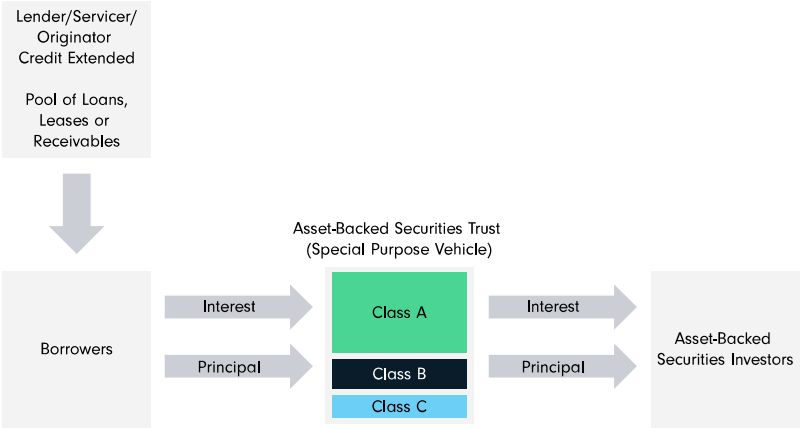

Securitization begins when a lender and borrower agree on loan terms, including amount, interest rate, collateral and maturity. The loan is then sold or pledged to a trust with similar loans, creating a securitized product. Bankers analyze expected cash flows, including interest, principal, prepayments, expected delinquencies and defaults, and recoveries. These cash flows are structured into securities that are broken down into tranches (e.g., Classes A, B, C) and sold to investors.

Historical data on credit trends are readily available for established markets like credit cards and automobiles. Deals may be submitted to rating agencies for review and preliminary rating, considering credit enhancements.

The non-rated securitized deal market has recently grown as issuers avoid rating agency fees, and some securities, like non-performing loans, are challenging to rate. More deals are issued under Rule 144A, which allows private placement without SEC registration. These securities often offer yield compensation due to potentially lower liquidity and may not meet specific institutional or private investor guidelines.